ETFGI reports record net inflows and record assets in the ETFs industry in Europe of 237.51 Bn and 2.29 Tn US dollars respectively at the end of November

Se vuoi ricevere le principali notizie di ETFWorld.it iscriviti alle Nostre Newsletters gratuite. Clicca qui per iscriverti gratuitamente

By Deborah Fuhr, Managing Partner at ETFGI

ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today record net inflows and record assets invested in the ETFs industry in Europe of US$237.51 billion and US$2.29 trillion respectively at the end of November. The ETFs industry in Europe gathered net inflows of US$29.72 billion during November, bringing year-to-date net inflows to a record US$237.51 billion, according to ETFGI’s November 2024 European ETFs and ETPs industry landscape insights report. (All dollar values in USD unless otherwise noted.)

Highlights

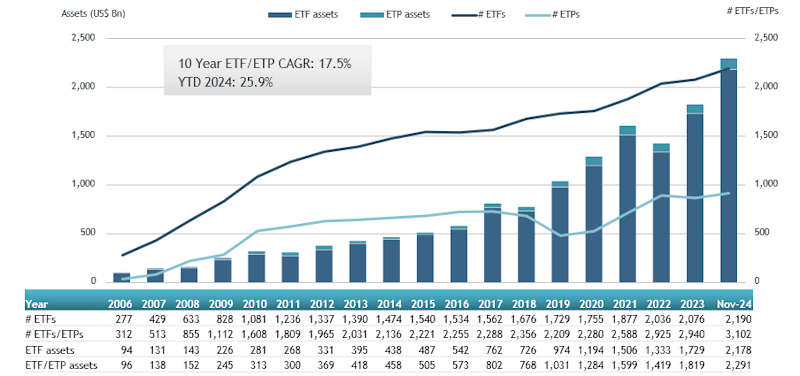

- Assets invested in the ETFs industry in Europe reached a record $2.29 Tn at the end of November beating the previous record of $2.25 Tn at the end of September 2024.

- Assets have increased 25.9% YTD in 2024, going from $1.82 Tn at end of 2023 to $2.29 Tn.

- Net inflows of $29.72 Bn gathered in November.

- YTD net inflows of $237.51 Bn are the highest on record, while the second highest YTD net inflows are $181.69 Bn in 2021 and the third highest YTD net inflows are $138.49 Bn in 2023.

- YTD net inflows of $237.51 Bn are higher than the full year record of $193.46 Bn in 2021.

- 26th month of consecutive net inflows.

“The S&P 500 index increased by 5.87% in November and is up 28.07% YTD in 2024. The developed markets excluding the US index increased by 0.11% in November and is up 6.77% YTD in 2024. Israel (up 8.86%) and US (up 6.46%) saw the largest increases amongst the developed markets in November. The emerging markets index decreased by 2.77% during November but is up 11.75% YTD in 2024. Indonesia (down 6.17%) and Philippines (down 6.05%) saw the largest decreases amongst emerging markets in November.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Asset growth in the ETFs industry in Europe as at the end of November

At the end of November, the ETFs industry in Europe had 3,102 ETFs, with 12,866 listings, assets of $2.29 Tn, from 107 providers listed on 29 exchanges in 24 countries.

During November, ETFs gathered net inflows to $29.72 Bn. Equity ETFs gathered net inflows of $29.91 Bn in November, bringing YTD net inflows to $174.59 Bn, higher than the $79.48 Bn in YTD net inflows in 2023. Fixed income ETFs had net outflows of $140.98 Mn during November, bringing YTD net inflows to $52.98 Bn, slightly lower than the $59.72 Bn in YTD net inflows in 2023. Commodities ETFs reported net outflows of $2.37 Bn during November, bringing YTD net outflows to $6.88 Bn, lower than the $6.96 Bn in net outflows commodities products had reported year to date in 2023. Active ETFs attracted net inflows of $2.40 Bn over the month, gathering net inflows for the year in Europe of $17.06 Bn, higher than the $6.23 Bn in net inflows YTD in 2023.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $26.13 Bn during November. iShares Core S&P 500 UCITS ETF (CSSPX SW) gathered $3.97 Bn, the largest individual net inflow.

Top 20 ETFs by net inflows in November 2024: Europe

Name | Ticker | Assets | NNA | NNA |

CSSPX SW | 110,317.77 | 16,571.86 | 3,969.45 | |

Xtrackers S&P 500 Equal Weight UCITS ETF (DR) – 1C | XDEW GY | 14,414.66 | 7,124.51 | 3,124.34 |

iShares Core MSCI World UCITS ETF | IWDA LN | 93,735.18 | 12,464.22 | 2,509.84 |

Invesco S&P 500 UCITS ETF – Acc | SPXS LN | 36,019.18 | 7,364.32 | 2,009.42 |

Amundi S&P 500 II UCITS ETF USD | LSPU LN | 16,232.56 | 3,481.41 | 1,618.86 |

Amundi Prime Global UCITS ETF Dist | MWOZ GY | 1,453.52 | 1,426.29 | 1,426.29 |

Vanguard S&P 500 UCITS ETF | VUSA LN | 63,947.86 | 5,627.41 | 1,192.56 |

SPDR S&P 500 UCITS ETF | SPY5 GY | 20,663.50 | 9,117.33 | 1,181.81 |

Amundi S&P 500 Equal Weight ESG Leaders UCITS ETF – Acc | WELE GY | 2,674.75 | 1,725.04 | 1,129.46 |

SPDR S&P 400 US Mid Cap UCITS ETF – Acc | SPY4 GY | 4,333.50 | 2,056.45 | 1,077.37 |

SPDR Russell 2000 U.S. Small Cap UCITS ETF – Acc | ZPRR GY | 4,744.87 | 1,734.85 | 969.16 |

JPMorgan US Research Enhanced Index Equity ESG UCITS ETF – Acc | JREU LN | 12,862.83 | 5,597.85 | 786.92 |

Vanguard FTSE All-World UCITS ETF | VWRD LN | 32,661.07 | 6,347.13 | 767.13 |

Xtrackers S&P 500 Equal Weight ESG UCITS ETF | XZEW GY | 2,668.94 | 2,071.44 | 728.78 |

iShares S&P 500 Equal Weight UCITS ETF | EWSP LN | 4,315.85 | 2,101.40 | 728.34 |

iShares S&P SmallCap 600 UCITS ETF | ISP6 LN | 2,995.20 | 1,149.58 | 717.57 |

SPDR MSCI World UCITS ETF – Acc | SPPW GY | 10,472.73 | 4,570.10 | 640.54 |

iShares S&P 500 Financials Sector UCITS ETF | IUFS LN | 2,209.38 | 758.57 | 552.04 |

Xtrackers Russell 2000 UCITS ETF (DR) – 1C | XRS2 GY | 2,210.04 | 839.87 | 509.94 |

SPDR Bloomberg 1-3 Month T-Bill UCITS ETF | ZPR1 GY | 1,053.57 | 632.29 | 485.78 |

The top 10 ETPs by net new assets collectively gathered $853.57 Mn during November. SMO Physical Gold ETC (BARS LN) gathered $149.69 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in November 2024: Europe

Name | Ticker | Assets | NNA | NNA |

SMO Physical Gold ETC | BARS LN | 1,109.62 | 1,057.21 | 149.69 |

iShares Physical Silver ETC | SSLN LN | 1,063.63 | 368.37 | 121.54 |

WisdomTree Physical XRP | XRPW NA | 141.46 | 114.06 | 114.06 |

VanEck Sui ETN | VSUI FP | 115.62 | 112.62 | 112.62 |

XRPetc – ETC Group Physical XRP | GXRP GY | 113.05 | 83.75 | 82.44 |

WisdomTree Physical Swiss Gold | SGBS LN | 3,147.37 | (25.91) | 73.64 |

WisdomTree Core Physical Gold | WGLD LN | 1,170.86 | 386.23 | 72.53 |

WisdomTree Physical Platinum | PHPT LN | 550.05 | 204.68 | 52.94 |

Bitwise Aptos Staking ETP | APTB SW | 44.26 | 40.28 | 40.28 |

AMUNDI PHYSICAL GOLD ETC (C) – Acc | GOLD FP | 5,186.23 | 47.42 | 33.82 |

Investors have tended to invest in Equity ETFs during November.

ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

Fonte: ETFWorld