ETFGI reports that assets invested in the Global ETFs industry reached a new milestone of US$11.73 trillion at the end of January

Se vuoi ricevere le principali notizie di ETFWorld.it iscriviti alle Nostre Newsletters gratuite. Clicca qui per iscriverti gratuitamente

By Deborah Fuhr, Managing Partner at ETFGI

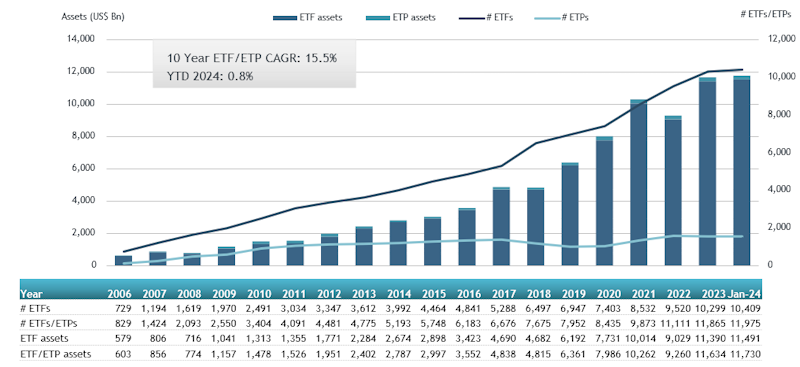

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that assets invested in the Global ETFs industry reached a new milestone of US$11.73 trillion at the end of January. The global ETFs industry gathered US$136.80 billion in net inflows in January. During the month, assets invested in the global ETFs industry increased by 0.8%, from US$11.63 trillion at the end of December to US$11.73 trillion, according to ETFGI’s January 2024 global ETFs industry landscape insights report. (All dollar values in USD unless otherwise noted)

Highlights

- Assets invested in the global ETFs industry reached a new milestone of $11.73 Tn at the end of January beating the previous record of $11.63 Tn set at the end of December 2023.

- Net inflows of $136.80 Bn during January.

- January net inflows of $136.80 Bn are the highest on record, while the second highest recorded January net inflows was of $105.59 Bn in 2018 and the third highest was $85.28 Bn in 2021.

- 56th month of consecutive net inflows.

“The S&P 500 increased by 1.68% in January. Developed markets excluding the US decreased by 0.31% in January. Hong Kong (down 9.80%) and Korea (down 9.69%) saw the largest decreases amongst the developed markets in January. Emerging markets decreased by 3.46% during January. China (down 11.18%) and Chile (down 9.68%) saw the largest decreases amongst emerging markets in January,” according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Global ETFs industry asset growth as of the end of January

![]()

The Global ETFs industry had 11,975 products, with 24,041 listings, assets of $11.73 Tn, from 732 providers listed on 81 exchanges in 63 countries at the end of January.

During January, the ETFs industry gathered net inflows of $136.80 Bn. Equity ETFs gathered net inflows of $60.92 Bn during January, higher than the $21.81 Bn in net inflows in January 2023. Fixed income ETFs reported net inflows of $30.20 Bn during January, higher than the $26.79 Bn in net inflows in January 2023. Commodities ETFs/ETPs reported net outflows of $3.60 Bn during January, higher than the $305 Mn in net outflows in January 2023. Active ETFs attracted net inflows of $24.71 Bn during the month, higher than the $10.69 Bn in net inflows in January 2023.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $99.56 Bn during January. Grayscale Bitcoin Trust (GBTC US) gathered $20.52 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows January 2024: Global

Name | Ticker | Assets | NNA | NNA | |

Grayscale Bitcoin Trust | GBTC US | 20,708.06 | 20,519.16 | 20,519.16 | |

iShares Core S&P 500 ETF | IVV US | 414,144.37 | 11,980.06 | 11,980.06 | |

Vanguard S&P 500 ETF | VOO US | 388,654.25 | 9,842.92 | 9,842.92 | |

Invesco QQQ Trust | QQQ US | 241,543.34 | 7,116.59 | 7,116.59 | |

E Fund CSI 300 ETF | 510310 CH | 11,778.84 | 5,577.11 | 5,577.11 | |

Harvest CSI 300 Index ETF – Acc | 159919 CH | 9,748.74 | 4,296.19 | 4,296.19 | |

Huatai-Pinebridge CSI 300 ETF | 510300 CH | 21,224.85 | 4,288.28 | 4,288.28 | |

iShares S&P 500 Value ETF | IVE US | 31,005.20 | 3,521.80 | 3,521.80 | |

China AMC CSI 300 Index ETF | 510330 CH | 8,386.26 | 3,447.62 | 3,447.62 | |

iShares iBoxx $ Investment Grade Corporate Bond ETF | LQD US | 35,071.60 | 3,246.54 | 3,246.54 | |

iShares Core S&P 500 UCITS ETF – Acc | CSSPX SW | 75,956.98 | 3,013.81 | 3,013.81 | |

Blackrock US Equity Factor Rotation ETF | DYNF US | 2,860.89 | 2,857.32 | 2,857.32 | |

iShares Bitcoin Trust | IBIT US | 2,836.69 | 2,800.04 | 2,800.04 | |

Vanguard Total Stock Market ETF | VTI US | 351,708.09 | 2,722.90 | 2,722.90 | |

iShares Core Total USD Bond Market ETF | IUSB US | 26,347.89 | 2,579.88 | 2,579.88 | |

China AMC China 50 ETF | 510050 CH | 13,512.97 | 2,552.47 | 2,552.47 | |

Fidelity Wise Origin Bitcoin Fund | FBTC US | 2,535.43 | 2,503.89 | 2,503.89 | |

VanEck 1-5 Year Australian Government Bond ETF | 1GOV AU | 2,495.45 | 2,494.11 | 2,494.11 | |

Invesco Nasdaq 100 ETF | QQQM US | 21,025.25 | 2,121.77 | 2,121.77 | |

iShares Core € Corp Bond UCITS ETF | IEBC LN | 19,440.06 | 2,079.63 | 2,079.63 |

The top 10 ETPs by net new assets collectively gathered $816.17 Mn over January. AMUNDI PHYSICAL GOLD ETC (C) – Acc (GOLD FP) gathered $289.06 Mn, the largest individual net inflow.

Top 10 ETPs by net new inflows January 2024: Global

Name | Ticker | NNA | NNA | NNA | |

GOLD FP | 4,205.30 | 289.06 | 289.06 | ||

WisdomTree Copper – Acc | COPA LN | 1,410.55 | 125.34 | 125.34 | |

NH QV KIS CD Interest Rate Investment ETN 82 | 550082 KS | 386.40 | 77.28 | 77.28 | |

WisdomTree Core Physical Gold – Acc | WGLD LN | 631.06 | 56.80 | 56.80 | |

MAX S&P 500 4X Leveraged ETN | XXXX US | 89.87 | 50.25 | 50.25 | |

SG ETC FTSE MIB -3x Daily Short Collateralized – Acc | MIB3S IM | 5.69 | 47.61 | 47.61 | |

Leverage Shares 3x Tesla ETP – Acc | TSL3 LN | 137.48 | 45.96 | 45.96 | |

SPDR Gold MiniShares Trust | GLDM US | 6,378.49 | 44.02 | 44.02 | |

WisdomTree WTI Crude Oil – Acc | CRUD LN | 813.78 | 39.99 | 39.99 | |

MicroSectors FANG+ ETNs | FNGS US | 234.16 | 39.88 | 39.88 |

Investors have tended to invest in Equity ETFs during January.

ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

Se vuoi saperne di più : ETF cosa sono e come funzionano

Fonte: ETFWorld