ETFGI reports Crypto ETPs listed globally suffered net outflows of US$83 million during August 2022

Se vuoi ricevere le principali notizie di ETFWorld.it iscriviti alle Nostre Newsletters gratuite. Clicca qui per iscriverti gratuitamente

By Deborah Fuhr, Managing Partner at ETFGI

Highlights

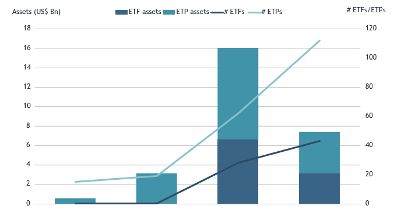

Assets of $7.39 Bn invested in Crypto ETFs and ETPs listed globally at the end of August 2022.

Assets have decreased 54.0% during 2022 going from $16.05 Bn at end of 2021 to $7.39 Bn.

Net outflows of $83 Mn during August 2022.

Year-to-date net outflows of $712 Bn during 2022.

$5.64 Bn in net outflows gathered in the past 12 months.

1st month of outflows.

“The S&P 500 decreased by 4.08% in August and is down by 16.14% YTD in 2022. Developed markets excluding the US decreased by 4.39% in August and are down 19.53% YTD in 2022. Sweden (down 10.80%) and Netherlands (down 9.52%) saw the largest decreases amongst the developed markets in August. Emerging markets increased by 1.46% during August but are down 15.23% YTD in 2022. Turkey (up 19.47%) and Pakistan (up 15.39%) saw the largest increases amongst emerging markets in August, while Poland (down 10.78%) and Czech Republic (down 8.75%) saw the largest decreases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The Global Crypto ETF/ETP had 155 ETFs/ETPs, with 461 listings, assets of $7.39 Bn, from 31 providers on 17 exchanges in 14 countries. Following net outflows of $83 Mn and market moves during the month, assets invested in Crypto ETFs/ETPs listed globally decreased by 10.0% from $8.22 Bn at the end of July 2022 to $7.39 Bn at the end of August 2022.

Global Crypto ETF and ETP asset growth as at end of August 2022

Since the launch of the first Crypto ETF/ETP in 2015, the Bitcoin Tracker One-SEK, the number and diversity of products have increased steadily, with 155 Crypto ETFs/ETPs and 461 listings globally at the end of August 2022. During August, no new Digital Asset ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $74.17 Mn during August. CI Galaxy Ethereum ETF (ETHX/B CN) gathered $14.77 Mn, the largest individual net inflow.

Top 20 Crypto ETFs/ETPs by net new assets August 2022

Name | Ticker | Assets ($ Mn) Aug-22 | NNA ($ Mn) YTD-22 | NNA ($ Mn) Aug-22 |

CI Galaxy Ethereum ETF | ETHX/B CN | 345.41 | (152.80) | 14.77 |

Ether Tracker One – Acc | COINETHE SS | 433.57 | (136.59) | 8.88 |

BTCetc – Bitcoin ETP – Acc | BTCE GY | 329.77 | (53.12) | 8.60 |

ProShares Short Bitcoin Strategy ETF | BITI US | 85.59 | 93.24 | 7.29 |

CoinShares Physical Bitcoin – Acc | BITC SW | 192.84 | 48.59 | 4.84 |

Hashdex Nasdaq Crypto Index ETF | HDEX BH | 245.79 | 80.85 | 4.66 |

Hashdex Nasdaq Crypto Index Fundo de Índice | HASH11 BZ | 212.47 | 92.44 | 4.41 |

CoinShares Physical Ethereum – Acc | ETHE SW | 110.69 | 33.80 | 3.36 |

VanEck Ethereum ETN – Acc | VETH GY | 63.31 | 12.46 | 2.38 |

Purpose Bitcoin Yield ETF | BTCY/B CN | 26.17 | 43.67 | 1.96 |

Hashdex Nasdaq Ethereum ETF | HETH BH | 19.45 | 11.44 | 1.92 |

Hashdex Nasdaq Ethereum Reference Price Fundo de Índice | ETHE11 BZ | 19.72 | 11.64 | 1.76 |

21Shares Crypto Basket 10 ETP | HODLX SW | 4.38 | 4.54 | 1.42 |

Betapro Inverse Bitcoin ETF | BITI CN | 50.38 | 14.89 | 1.35 |

Purpose Ether Yield ETF | ETHY/B CN | 35.85 | 59.40 | 1.34 |

Bitcoin ETF – CAD – Acc | EBIT CN | 49.21 | 8.44 | 1.25 |

21Shares Bitcoin ETP – Acc | ABTC SW | 168.51 | 42.38 | 1.10 |

Empiricus Teva Criptomoedas Top20 Fundo de Indice Investimento no Exterior | CRPT11 BZ | 8.13 | 10.84 | 1.04 |

Vaneck Bitcoin Strategy ETF | XBTF US | 19.54 | 22.06 | 0.98 |

21Shares Ethereum ETP – Acc | AETH SW | 204.18 | 20.38 | 0.89 |

ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

Se vuoi saperne di più : ETF cosa sono e come funzionano

Fonte: ETFWorld